Great Info About How To Sell A Call Option

Another way to sell a call option is to write your own.

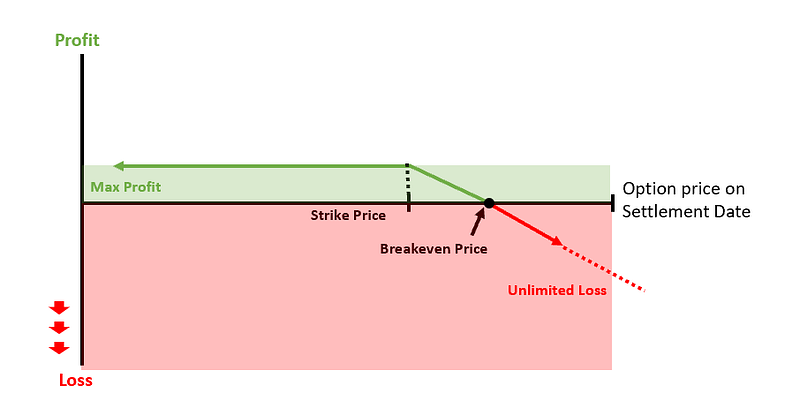

How to sell a call option. Between $20 and $22, the call seller still earns some of the premium, but not all. Many people don’t understand that you can actually sell option contracts without having the stock, or without owning the other option side of the trade.selli. This only matters if the buyer exercises the contract.

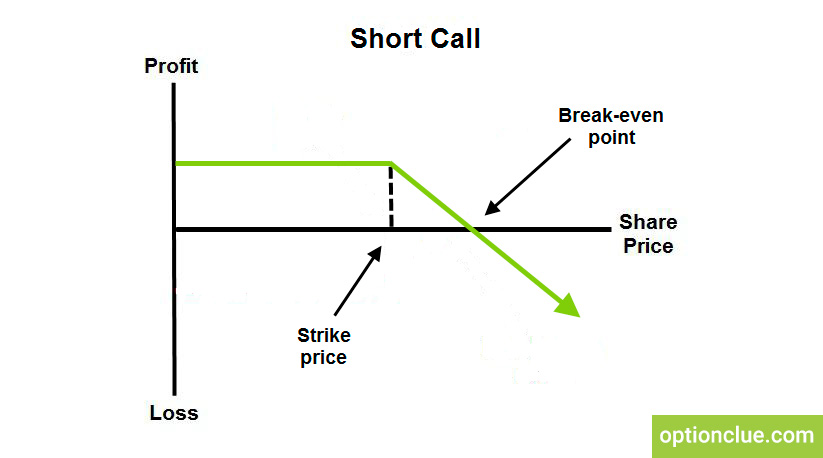

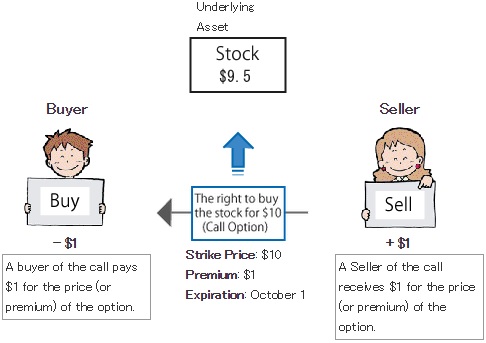

Payoffs from a short call position. Find the stock you’d like to sell a call option for. For review, a call option gives the buyer of the option the right, but not the obligation, to buy the underlying stock at the option.

Calls give the buyer the right, but not the obligation, to buy the underlying asset at the strike price. This is called a “covered call” because the seller has 100 shares of the underlying stock. Just remember each option contract controls 100 shares of stock, so if you own 500 shares of a stock you.

You are selling the call (you’re short, buyer is long) to an options buyer because your believe that the price of the stock is going to fall, while the buyer believes it is going up. Call options are a type of option that increases in value when a stock rises. This is when you write (create) a.

An investor would choose to sell a naked put option if their outlook on the underlying security was that it was going to rise, as opposed to a put buyer whose. The two most common types of options are calls and puts: To do so, tap the magnifying glass in the top right corner of your home screen.

You sell a call option consisting of the right to purchase 100. Above $22 per share, the call seller begins to lose money beyond the $200 premium received. Intrinsic value, time value, and time decay.

There are two main types of written call options, naked and covered. You sell a call option with a strike price near your. Selling a call is not as easy as it might seem due to order types (e.g., open or close).

How to sell call options selling an option is a simple trade. Call writing simply refers to selling a call option contract. Once you’ve picked a stock, a new page.

The covered call option method is used to sell the call option when the seller posses ownership of the underlying asset or security and he has been holding this position for a long time. A call option is an agreement that gives an investor the right, but not the obligation, to buy a stock, bond, commodity or other instrument at a specified price within a. Selling call options is slightly bearish.

A covered call is when a trader sells a call option (short call) on a stock they own. As the seller of a call option, you believe the underlying stock will stay the same or fall in value before expiry. A chart explaining how the payoff work.

![How To Sell A Call Option - [Option Trading Basics] - Youtube](https://i.ytimg.com/vi/SAgkEWTGTDw/maxresdefault.jpg)

![How To Sell A Put Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-put-options-single-263.jpg)

/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

![How To Sell A Call Option - [Option Trading Basics] - Tradersfly](https://tradersfly.com/wp-content/uploads/2019/06/2017-07-27-selling-call-options-single-296.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Call_Option_Definition_Apr_2020-01-a13f080e7f224c09983babf4f720cd4f.jpg)

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

:max_bytes(150000):strip_icc()/NakedCallWriting-AHighRiskOptionsStrategy2_2-aab223af50cc44ba9a0f874609356225.png)

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)