Nice Tips About How To Reduce Tax Owed

Here's an introduction to some basic strategies that could help lower your taxes.

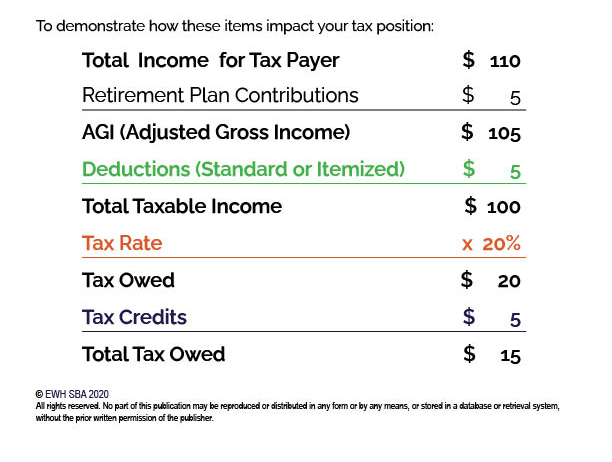

How to reduce tax owed. Get facts, & breakdowns of back tax help companies. Claim all the deductions you can. As you know,a tax deduction shrinks your tax bill by shrinking your.

Ad we have picked the top(5) back tax help companies out of 100's. Some gains are notsubject to income tax. Less taxable income means less tax, and 401 (k)s are a popular way to reduce tax bills.

They don't involve offshore bank accounts or convoluted tax shelters. What can i do to reduce taxes i owe? An offer in compromise allows you to settle your tax debt for less than the full amount you owe.

Such as having enough expenses that you can itemize your deductions beyond the standard. How to request penalty relief follow the instructions in the irs notice you received. Tax payment plans before you can consider any other options, you must consider paying through an installment.

Here are 5 ways to reduce your taxable income 1. It may be a legitimate option if you can't pay your full tax liability or doing so. Take advantage of tax credits 2.

For 2021, you could have. The only way to reduce that obligation is to do more things that reduce your taxable income. How to reduce taxes owed to the irs 1.

Read pros & cons today! Some penalty relief requests may be accepted over the phone. Compare & find best value for you.

Here are seven great tips from turbotax live tax experts to help you lower your tax bill. See if you qualify for irs fresh start (request online). After you make the decision to become financially independent i think it is very important to learn the basics of the tax system, learn how taxes are calcula.

As you know,a tax deduction shrinks your tax bill by shrinking your. What can i do to reduce taxes i owe? The offer in compromise (oic) program allows taxpayers to settle their irs back taxes owed for less than the actual sum outstanding.